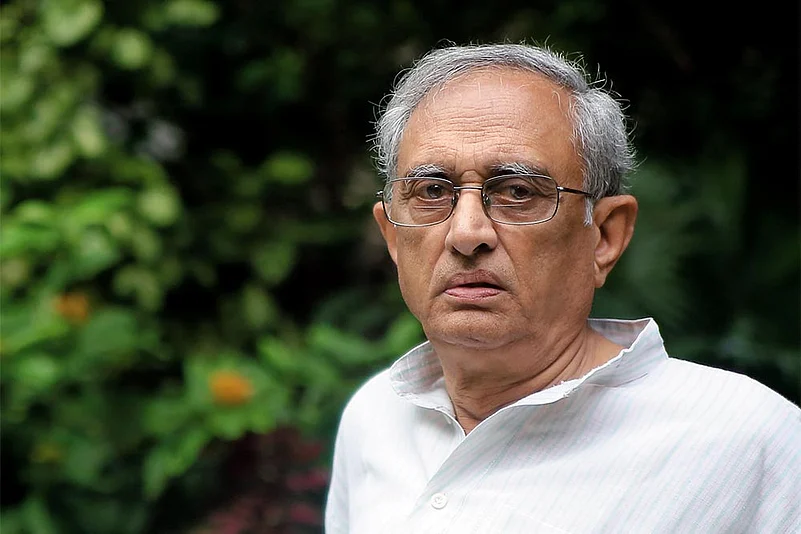

The small people at the receiving end in almost every sector of the economy are the ones who are finding themselves squeezed in the present demonetisation drive, while the “big fish have enough cushion, innovative capacity and political patronage to absorb the shock”, former economic affairs secretary and anti-corruption activist E.A.S. Sarma tells Lola Nayar. Excerpts from the interview:

The Big Fish Can Absorb This Shock: Anti-Corruption Activist Sarma

Former economic affairs secretary and anti-corruption activist E.A.S. Sarma on how it is only the small who are at the receiving end in the current demonetisation drive.

Will the government realise its objective of mopping up unaccounted money and crippling the parallel economy through the so-called surgical strike on black money? Or are there enough loopholes through which money is being laundered?

In principle, all measures to flush out black money, including demonetisation of higher denomination currency notes, are welcome. In deciding on such an approach, one has to weigh the perceived benefits vis-a-vis the costs.

The larger part of our economy comprises the -unorganised sector, predominantly characterised by cash transactions. This includes millions of workers, small traders, artisans, vendors, hawkers, marginal farmers and so on. They hoard cash because they are not used to banking or they do not trust the banks or they do not wish to be at the receiving end of the income tax staff. The “surgical strike” has directly -affected all of them and traumatised their lives.

The big fish who evade taxes invest in benami real estate property, illicit offshore accounts and other undeclared assets like overseas mineral blocks, luxury hotels and so on. They may also hoard cash, but only in limited quantities—for bribing politicians and officials. Such big fish have enough cushion, innovative capacity and political patronage to absorb the shock of demonetisation that the NDA government has resorted to. As soon as demonetisation was announced, they were quick to “employ” intermediaries to take care of their currency notes. Others who are not so big have even made a business out of demonetisation.

Would you agree the government rushed in without adequate preparations, leading to -chaos, and leaving the banking system grappling solely with exchange of old currency without dispensing money through ATMs?

Demonetisation necessarily involves an element of surprise and that makes it difficult for the government to prepare the banking system to gear up to it. The government could have, in close coordination with the RBI, flooded the banks and ATMs with lower denomination currency notes and increased the number of ATMs, at least a year in advance of demonetisation. Even this is easily said than done, as any sign of the government’s intentions would have alerted the clever cash hoarders. What surprises and distresses me is that none in the PMO, the finance ministry and the RBI could anticipate the rush and prepare themselves to deal with it.

What is the next step you would expect the government to take? A greater push towards cashless transactions? Target benami transactions? Grea-ter transparency in election funding?

The rush has taken by surprise those in the government who are dealing directly with demonetisation. They are, therefore, putting up a brave face and giving the impression that they will take many more measures to deal with black money. If they do so, it will be welcome, but it is doubtful that they will do it as the foundation of most elected political parties comprises black money.

If they are really serious about this, they should launch forensic investigations into benami assets of individuals, both domestic and overseas, donations to political parties, their election spending, all individual cases of conspicuous consumption and lavish spending, all larger cases of bank NPAs and so on. However, none of the political parties is willing to subject itself to the requirement of transparency -under the RTI Act. Both the Congress and the BJP have wantonly violated the Foreign Contributions Regulation Act (FCRA), but are unwilling to face prosecution under that Act, despite a court directive to that effect. The NDA government has gone one step backwards and retrospectively amended the FCRA to permit political parties to accept donations from foreign companies, knowing well that such a step will compromise the national interest. None of these political parties has acted firmly against any of the big bank loan defaulters and, in fact, have deliberately permitted them to go scot-free. Therefore, one gets the impression that none of the larger political parties has any inclination to fight the twin scourges of black money and corruption.

Is cashless economy feasible in India, given the small transactions most people have in their everyday lives and the cost charged per transaction besides the technical challenges?

“Cashless economy” will not be possible in the -immediate future, as public confidence in plastic money or the banking system is still low. Everybody knows how the banks have diverted lakhs of crores of rupees of public money to a few influential business houses and that the prospects of recovering that money are doubtful. Similarly, more than 3 million debit cards in India have recently been hacked and it is ironic that the government should talk of a cashless economy against that background.

What sort of impact do you see on the econ-omy and which sector or segment is likely to be squeezed the most in the current transition to higher denomination currency of Rs 2,000?

The small people at the receiving end of almost all sectors of the economy find themselves squeezed in the present demonetisation drive. None of the big fish, including the vocal politicians, is seen standing in the serpentine queues at the banks and the ATMs. I do not find any sense in the government making a hue and cry about introducing Rs 2,000 curre-ncy notes in undue haste. Instead, the government should have focussed on lower denomination notes.

Will demonetisation make any dent on the outflow of unaccounted money? If not, how do you expect the government to tackle the problem of funds parked overseas?

Illicit money flows to foreign destinations originate from political and bureaucratic corruption in the country. The funds stashed outside are used to fund lavish election rallies and election spending. Everyone knows how senior political leaders, who are now waxing eloquent on the need to flush out black money, were spending lavishly on their respective election rallies using corporate donations, some disclosed and mostly undisclosed. The parties that come to power have no qualms in granting illegal quid pro quos to the business houses that contributed to their electioneering. At the centre of this vicious cycle of corruption and money-laundering lie most illicit overseas accounts. Unless a focused attack is made on election spending, political donations and lavish spending by politicians and their cronies, -bureaucrats and others, the government will not make any dent on black money and corruption. Chief ministers of some states and other senior politicians are known to have undeclared offshore -accounts and I have personally lodged complaints with the central investigating agencies to investigate the same and bring the culprits to book. Though I have been writing to them for a couple of years, they have not responded, as they are apparently constrained by those influential in the government.

Do you foresee any impact on the domestic market? There is talk of the government proposing to keep a check on market liquidity. Do you -anticipate any such move?

The adverse impacts of demonetisation on the economy and the domestic market will be temporary, as they are sufficiently resilient to adjust themselves to the disruptive effect of demonetisation. My worry is that all the money that has now entered the banking system as a result of demonetisation will once again be in the hands of the banks who, in turn, will fail to exercise prudence under duress in extending further loan assistance to the same corporates that haven’t repaid the earlier loans. Several of those who have won coal and mineral blocks and spectrum in the recent auctions belong to this category and there are already signs of the government pressurising the banks to support them through additional loans. It is, therefore, doubtful that the government will be prudent enough to utilise the benefits of dem-onetisation so as to strengthen the economy and invest the funds in social sector spending, which is necessary for enhancing the welfare of the low-income sections of the population who contribute significantly to nation-building.