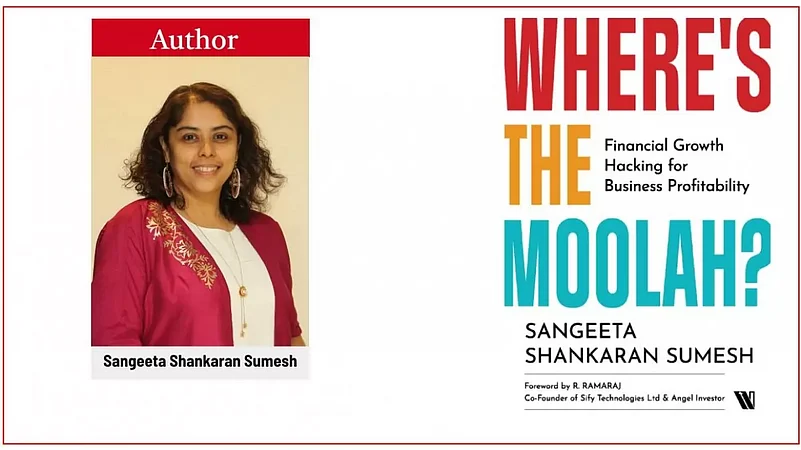

As a chief financial officer-turned-business and leadership coach, it made sense for Sangeeta Shankaran Sumesh to put pen to paper and share her learnings from over more than two decades of working with corporates. “It started with asking myself what more I could add over and above my 25 years of corporate experience. That led me to listening related podcasts, watching videos and, most importantly, the valuable discussions with the leaders I interviewed for the book,” says Shankaran Sumesh. Thus was born the book Where’s The Moolah?—Financial Growth Hacking for Business Profitability.

A Hack for Profitability in Business

In Where’s the Moolah?, Sangeeta Shankaran Sumesh draws from her own corporate experience as well as case studies to guide entrepreneurs and businesspersons towards effective financial management

The book talks about how each business function can pivot on finance to maximise profitability. Shankaran Sumesh was clear that she did not want her book to be a heavy read. “I was also on the lookout for my real-life experiences as a customer, potential consumer and observer. I have intertwined these in the book, to share different perspectives that could help practically and result in easily implementable actions,” she says.

“I particularly enjoyed the thoughts of C.K. Ranganathan, chairman of CavinKare, and Harish Lakshman, vice chairman of Rane Group, as well as the practical ideas of Nalli Kuppusamy Chetty [textile industrialist],” she says. “Apart from the industry leaders, I also interviewed people like auto driver Annadurai for highlighting the importance of creating the customer experience and Dr Srimathy Kesan, founder of Space Kidz, to understand how she built her business just with an idea despite having no business background,” she adds.

Optimising Operations

Much like a vehicle that needs all its four wheels in perfect shape to move ahead efficiently, business needs its functions to operate optimally, the author explains. “The common wheels of a business are customer, people, strategy, marketing, etc. which contribute to profits. It is essential for all the business functions to sync together to maximise the financial potential to achieve better profitability,” she adds.

Where’s The Moolah? explains how the business wheel can be leveraged for better financial growth.

The book dives into each of the business functions and shares the different possible ways to pivot on each function from the finance perspective leading to growth hacking for profitability as well as better cash management.

Here is an excerpt:

The onus lies on you as the business owner/head to ensure the competency of the business wheels, so that it can aid the financial growth. There is a clear link between the roles of each business wheel on the financial situation of your business. You need to be cognisant of the modalities of each function and have a watchful eye on each of the wheels, at all times, while focusing on the financial wellness of the business.

To illustrate further, here is what happens typically when an organisation decides to go on a cost cutting spree. In order to reduce costs, most businesses tend to cut the head count, which is a low hanging fruit. By letting go of the staff, not paying bonuses, decreasing or postponing the increments etc. does not send the right messaging to the teams as the employees feel demotivated and insecure. When there is insecurity amongst your employees, it is highly probable, the best members in the team will tend to leave your organisation, resulting in drop in quality and levels of output, impacting the top line. Further some disgruntled employees who have been asked to leave, may also decide to resort to the legal course, which could only increase the costs & not to mention the extra time and effort with the legal cases.

Similarly cutting the prices with the suppliers drastically, reducing the marketing spend, disapproving investing in technology and holding all the business payments, only makes it a short term win for the business but in the long term it may not help. Because with such actions taken, the employees and the suppliers sense it & get into a panic mode, resulting in compromising the quality, which in turn creates unhappy customers and therefore decreases your turnover. With this approach, there are good chances that the high performing employees also look for other opportunities & could take away some of your customers along.

Thus, each of the wheels of the business are interlinked and interdependent on each other.

Going Ahead

Shankaran Sumesh is also the author of spiritual thriller titled A Glance at the Unknown, a book on finance titled What The Finance and Get High: How to Coach yourself for high performance in your work.

Writing enabled her to think a lot, reflect, be more aware as well as deep dive into the topics, she says. Meanwhile, she continues to explore how she can contribute further by combining her finance background, leadership experience and coaching skills, even as workshops for corporates and masterclasses on Where’s The Moolah? keep her engaged.